Are you familiar with the financial terms that facility managers and capital planners use to make informed decisions? From calculating the Payback Period to determining the Return on Investment and completing a cost/benefit analysis, many tools can help you assess the financial viability of your projects. In this blog, we'll explore these concepts and show you how to apply them. So, if you're ready to take your financial management skills to the next level, read on!

Quick View: Secure Funding for Capital Improvement Projects

- How to present data to the CFO.

- Financial analysis tactics.

- Calculate Life Cycle Costs and Total Cost of Ownership.

How to Get Your Projects Funded: A Guide to Capital Budget Financial Analysis for Facility Managers

Preparing and presenting a funding proposal is a challenging task. This guide breaks down standard financial analysis models so that you can demonstrate your financial expertise to the CFO and get your projects funded!

In this blog, you will learn:

- Simple capital budgeting analysis methods include the payback period and return on investment.

- Demystify the complex budgeting concepts of Life Cycle Costing and Total Cost of Ownership.

- Explain how to develop a proposal that will resonate with financial decision-makers.

Armed with a solid understanding of these financial concepts, you can strategically plan for long-term capital projects and be empowered to confidently request funding for the capital projects you want to complete.

What is Capital Budgeting?

Capital budgeting is the planning process used by organizations to evaluate, appraise, and determine which project expenditures and investments are worth pursuing. This includes investing in new construction, machinery, plants, and other long-term ventures for facility managers. High-dollar expenditures include purchasing fixed assets, such as land, buildings, and new equipment, as well as rebuilding or replacing existing equipment, and research and development.

The large amounts spent on these projects are known as capital expenditures. Capital budgeting is crucial for optimizing funds and maximizing an organization's future growth. However, companies can only manage a limited number of large projects at a time.

Learn how FOUNDATION-Plans can make the Capital Budgeting process easier for your organization.

A capital budgeting plan takes into account the calculation of each project’s cash flow by period, the present value of cash flows after time value of money, the number of years it takes for a project to recover the initial cash investment, a risk assessment, and other factors.

What is the Goal of Capital Budget Analysis?

Capital budget analysis aims to put various numbers into perspective. It provides context for the costs of physical assets against an organization's operating budget.

This analysis helps Facilities Managers (FMs) decide which projects to fund and which to defer. It is based on project rankings, which are measured against benchmarks and compared to one another. If your projects pass the benchmark, they are worth pursuing.

Software, like FOUNDATION-Plans, makes Capital Budget decision-making more manageable. Our platform features a system that associates costs with building deficiencies, prioritizes construction projects, and provides in-depth analysis reporting. These reports are essential in helping facility managers demonstrate to the CFO or other key financial executives that the projects they seek approval for are critical to the facility's long-term health.

Software in Action

For example, we have collaborated with the New York Department of Education (NY DOE) and the School Construction Authority (SCA) since 1998 to develop a system that provides comprehensive costing for the annual school construction budget.

Our solution, FOUNDATION-Plans, allows the DoE to generate comprehensive reports based on specific SCA requirements, and our costing calculation software enables report generation based on inspection deficiencies.

Their Five-Year Capital Plan, which regularly encompasses $14 to $16 billion in project planning, requires assessments across the entire network of New York City's public schools. Following these building inspections, the agency prioritizes which problems to address, the cost of each project, and the time required to implement each project. Before working with Intellis, this process was arduous, inefficient, and often inaccurate.

Find out how software improves the capital budgeting process for the NYC Department of Education.

Deficiencies identified during the inspection process, using facility condition assessment software developed by Intellis, FOUNDATION-Conditions, are costed and prioritized using the Deficiency Costing Prioritization system. This system allows the DoE and SCA to prioritize the deficiencies of 1,700 public schools using built-in algorithms and reporting.

After implementing our FOUNDATION Solution, the agency produced a more accurate and transparent 5-Year Capital Plan Amendment, which included an increase of over $1 billion for enhanced educational services and better facilities for NYC schools.

With the help of FOUNDATION, the DoE and SCA have seen an average annual funding increase of $1 billion. We are proud to continue working with the DoE and SCA to produce these amendments, optimizing and enhancing Capital Planning, so that facility managers can provide enhanced educational services and better facilities, thereby securing safe and modern learning environments for students and teachers.

The Basics: Capital Budget Analysis

We will discuss more straightforward capital budget analysis methods, such as the Payback Period and Return on Investment. Although facilities are often viewed as a cost center that can be controlled by eliminating a line or two on a budget, current financial conditions have pressured the facility department to demonstrate tangible business value across the entire enterprise.

Upper management wants to know how much return it receives on its long-term facility investments. To gauge the actual value of a capital plan, facility executives must look beyond cost savings.

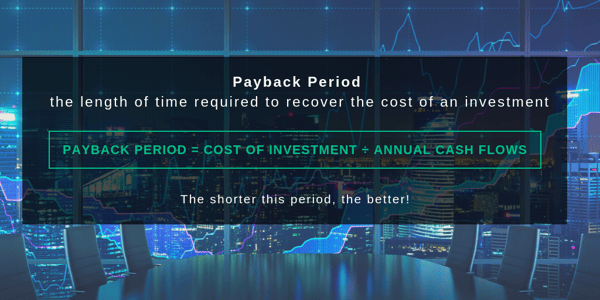

Payback Period

The Payback period refers to the time it takes to recoup project investment costs from the savings obtained from the capital budget. The payback period of a given investment or project is an essential determinant in deciding whether to fund a particular project. Generally, more extended payback periods are not desirable.

Return on Investment (ROI)

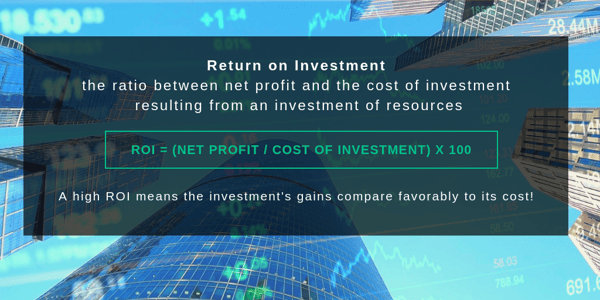

CFOs and other financial executives often discuss return on investment or ROI. ROI measures the gain or loss generated on an investment relative to the money invested. Typically, it is expressed as a percentage to compare a company's various project investments.

In short, ROI is a simple measure of profitability expressed as a percentage. The percentage returned is based on the initial capital invested. The rate of return, ratios, or money gains or losses on an investment are relative to the amount invested. You compare the maturity and timing of gains to investment costs and measure the cash generated by the asset.

Metrics that measure ROI align the goals of long-term facility projects with an organization's objective for a single department or enterprise. An intelligent facilities management system, such as FOUNDATION-Plans, can simplify the collection and analysis of data for capital projects.

More importantly, with FOUNDATION Plans, generating and sharing reports with financial executives is easier than ever. This will empower you with the right tools to tell a compelling story about why your project should be funded, because complex data will back your proposals.

Life Cycle Costs and Total Cost of Ownership

Life Cycle Costing (LCC) and Total Cost of Ownership (TCO) are some of the more buzzword financial terms in the facilities management sector. They are also referred to as whole-life costing, cradle-to-grave, or womb-to-tomb. Furthermore, they provide exact cost measurements.

Total Cost of Ownership and Life Cycle Costing are closely related analysis methodologies designed to reveal various lifetime costs associated with the ownership of specific types of assets. Along with purchase costs, TCO incorporates substantial costs for deploying, operating, upgrading, and maintaining the assets.

.png?width=600&name=Life%20Cycle%20Costing%20the%20total%20cost%20of%20ownership%20over%20the%20life%20of%20an%20asset%20(1).png)

Total Cost of Ownership

The Total Cost of Ownership (TCO) refers to all costs incurred throughout the lifetime of owning or using an asset. It typically goes beyond the original purchase price. TCO enables decision-makers to consider asset procurement more strategically (beyond the lowest bidder) and level the playing field when choosing among competitive bids, where the lowest-priced bid may or may not be the least costly asset to procure.

Life Cycle Costing

Life Cycle Costing (LCC) is a technique that establishes the total cost of ownership. It is a structured approach that can assist management in the selection process. It can consider any expenses that the selection team feels are appropriate. Maintenance, asset disposal, training, upgrade costs, energy consumption, resources used in manufacturing, and the cost of duplicate service during installation are all expenses that could be included in a Life Cycle Cost (LCC) analysis.

In short, TCO and LSS are methodologies for calculating the total cost of a system from inception to disposal. This includes financial expenses, which are relatively simple to calculate, and environmental and social costs, which tend to be more challenging to quantify. Typical expenditure areas included in calculating the LCC include planning, design, construction and acquisition, operations, maintenance, renewal and rehabilitation, depreciation, and the cost of finance, and replacement or disposal.

How to Sell Your Project

To successfully sell your capital improvement project, you must present a compelling business case backed by intelligent data. With a facilities management system like FOUNDATION-Plans, it is easy to convert your vision into operational objectives, link your capital project plan to individual performance and strategic planning, and highlight the outcomes for ongoing improvement.

Quick Tips

Successfully Selling the Capital Improvement Project

- Protecting the environment.

- Maintaining good relations with neighbors.

- Present the Business Case in 3 slides or fewer.

- Utilize financial analysis.

- Sustainability initiatives.

- Social initiatives.

How to Present Your Business Case

Consider how this facility capital project will benefit the CFO when developing your business case.

Presenting Capital Budget Projects

- Phrase your introduction in the form of a problem statement.

- Propose your solution.

- Present your Financial Analysis.

- Use Payback Period and ROI analysis.

- Explain sustainability benefits using Total Cost of Ownership and Life Cycle Costing.

- End with a specific and compelling example of how this capital project benefits society and, in turn, supports your organization's business goals.

Strategic Planning Leads to Better Long-Term Investments in Capital Projects

Financial analysis is crucial to the success of any facility capital project. As facility managers, using the proper metrics and economic terms to secure funding for your projects is essential.

Use economic models to justify financing for facility projects and present them to financial stakeholders. Don't let a lack of financial knowledge hold you back from achieving facility goals.

Schedule a demo with our team today, learn how Intellis improves capital budget planning with intelligent software, and get those projects funded!

Additional Resources

- What is the difference between Capital Investment and Capital Planning?

- How Facility Planning Software Supports Sustainability

- Top Challenges in Capital Planning for 2025 – And How to Overcome Them